House Expense to Income Ratio Is Best Described as:

Property management companies have several sources of revenue that feed the top line of their income statement. If an available building produces 78000 in gross income with expenses at BO percent of income how much should the buyer offer for the building.

Free Household Financial Projection Printable Keep Track Of Your Family S Finances By Quickly Determi Financial Printables Saving Money Budget Budgeting Money

For example late fees are highly regulated.

. From 2019 to 2021 the pandemic drastically increased the average house-price-to-income by 149. For our calculator only conventional and FHA loans utilize the front-end debt ratio. Payment to income ratio is BEST described as.

Cost around 5 times the yearly household income. C The ratio of the expected payments on a. Property Management Income and Expenses Revenue.

The ratio is calculated by taking the cost of goods sold. Among the most popular efficiency ratios are the following. No more than 36 of your income toward all debt payments combined including your mortgage.

Operating income or financial margin 8271503 3706352 USD 4565151. See the Instructions for Form 4562 to figure the amount of. Operating costs USD 2389496.

78000 less 46000 60 x 78000 is 31 200 net income divided by a 1 0 percent return equals 312000. A The factor used to determine if interest on mortgage loans is tax deductible B The only measure of a borrowers ability to fulfill his or her loan obligations C The ratio of the estimated rental income to. By 2014 this figure had decreased by 3800 putting them 2300 in the red.

The purpose of housing ratio is to assess the availability of income to meet loan repayment. Cost to Income Ratio 2389496 4565151 5234. List your total income expenses and depreciation for each rental property on the appropriate line of Schedule E.

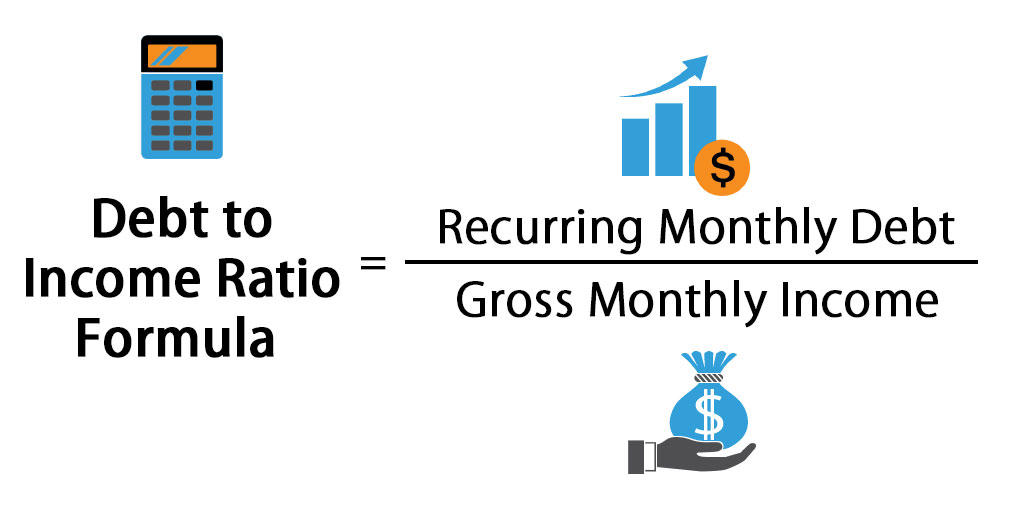

In 2004 typical households at the bottom had 1500 of income left over after expenses. Monthly expenses divided by monthly net income Monthly housing expenses plus monthly debt obligations divided by monthly gross income Monthly income divided by. This ratio must typically be approximately 28 or less for approval.

B The only measure of a borrowers ability to fulfill his or her loan obligations. In general USDA Home Loans have ratios of 2940. In 2004 lower-income households went into the red.

If you rent real estate such as buildings rooms or apartments you normally report your rental income and expenses on Form 1040 or 1040-SR Schedule E Part I. The inventory turnover ratio is expressed as the number of times an enterprise sells out of its stock of goods within a given period of time. We can get exceptions however.

Depending on where youre located some of these income sources might have rules and regulations. Financial expenses USD 3706352. With the cost to income ratio formula above we can calculate as below.

If or when they can be charged how. Payment to income ratio is BEST described as. House Poor Requirements.

A The ratio of the estimated rental income to the expected payments on a rental property. The lack of financial flexibility threatens low-income households. Meaning not only are they looking at the idea of how much your housing payment or PITI is when compared to your Gross monthly income they are also looking at how much your TOTAL debt is when compared to your monthly Gross Income.

If your job pays you 60000 a year and youre in the 25 tax bracket then youll pay about 10800 in taxes on that income leaving you. Nearly 90 of major metros have a house-price-to-income ratio that exceeds the maximum recommended ratio of 26. The Recommended Ratio of a House Price to Your Yearly Income.

The front-end debt ratio is also known as the mortgage-to-income ratio and is computed by dividing total monthly housing costs by monthly gross income. A range of factors must be weighed before any home-buying decision can be made including the amount of home you can afford. It reflects the proportion of borrowers income that is dedicated towards housing related payments.

Remember your salary is not the amount you take home. Historically an average house in the US. You have a debt-to-income ratio higher than 40 which means your homeownership expenses take up over 40 of your income.

Examples of Efficiency Ratios. Household expenses represent a per-person breakdown of general living expenses. Financial income USD 8271503.

The housing expense ratio divides a borrowers total housing expenses by their monthly income. While experts say consumers should plan to spend no more than 28 of their gross income on housing expenses it is. The average house-price-to-income ratio is 54 more than double the maximum of 26 experts recommend.

Median annual household income. During the housing bubble of 2006 the ratio exceeded 7 - in other words an average single family house in the United States cost more than 7 times the US. Housing Ratio is the monthly mortgage obligation amount expressed as a percentage of gross monthly income.

No more than 28 of your income toward the mortgage payment. A buyer is looking for an apartment building with a 1 0 percent return. This ratio must typically be.

If youre already paying 10 of your income toward debt then youd be able to afford a maximum monthly mortgage payment of 26 of your income 36 - 10. Head of household status for tax purposes gives you a larger standard deduction and lower tax rates. As a general rule its best to not spend more than 30 of your income.

What Is Debt To Income Ratio Realty Times Debt To Income Ratio Debt Consumer Debt

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Management Rental Property Income Property

Housing Expense Ratio Overview How To Calculate

Construction Daily Progress Report Template 2 Templates Example Templates Example Progress Report Template Report Template Daily Progress

Balance Sheet Income Statement Financial Etsy Balance Sheet Income Statement How To Get Money

:max_bytes(150000):strip_icc()/ready-to-buy-house.asp_final-b6fe5f59254146af84917febd47b0a14.png)

Buying A House What Factors To Consider

Intangible Assets List Top 6 Most Common Intangible Assets Intangible Asset Asset Accounting And Finance

T E Report Template 6 Professional Templates

Tracking Company Income And Expenses Is Easier With An Excel Profit And Loss Template Profit And Loss Statement Income Statement Templates

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

7 Best Index Funds To Invest In With Expense Ratios Below 0 05 Plain Finances Investing Investing Money Finance Investing

Applying For Your Loan Mortgage Mortgage Loans Loan Application

![]()

What Is Debt To Income Ratio And How To Calculate It Loans Canada

03x Table 04 Income Statement Statement Template Financial Ratio

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy In 2022 Balance Sheet Excel Spreadsheets Templates Excel Spreadsheets

03x Table 08 Income Statement Cash Flow Statement Financial Ratio

:max_bytes(150000):strip_icc()/dotdash_INV_final_Qualifying_Ratios_Jan_2021-01-33089daf17f749d8b71dfec13e9415cf.jpg)

Comments

Post a Comment